How Colorado Homeowners Can Postpone Property Tax Payments

If you find yourself in a panic over your property tax bill, a program in Colorado could offer you some much-needed relief.

Colorado's Property Tax Deferral Program allows homeowners to delay their property tax payments, potentially for several years, depending on their eligibility.

State Treasurer Dave Young emphasized the benefits of the program, stating, "Anytime we can keep folks in their homes and help them find tax relief at the same time is a win for Coloradans."

Under this program, homeowners can defer their tax payment for as long as they own their home. However, there is interest charged on the deferred amount, accruing slowly over time.

Eligibility for the program has traditionally been focused on seniors and active military personnel. Still, it was expanded last year to assist homeowners affected by increased property taxes between 2020 and 2023. The application deadline is April 1st.

Homeowners who aren't seniors or active military can also apply if their property taxes have increased beyond a specified "growth cap." This cap is met when the current year's property tax amount has increased by 4% or more compared to the average of the two preceding tax years.

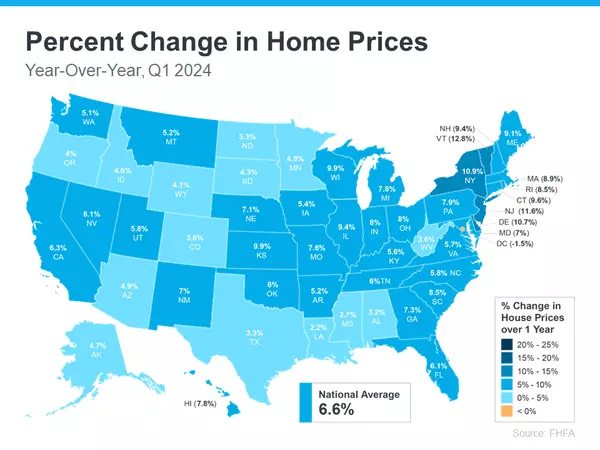

Given the significant spikes in property values observed in various parts of the state, many homeowners are likely to qualify for the program due to substantial increases in their property tax bills.

It's important to note that the program does not exempt homeowners from paying taxes altogether. Instead, it functions as a loan that homeowners repay later.

Seniors and active military personnel must reapply for deferral each year, while others eligible under the growth cap-based criteria can defer for as long as they own their home, provided the deferred amount does not exceed $10,000.

Homeowners are not required to pay any portion of their deferred tax amount, including interest, as long as they continue to reapply annually.

The current interest rate for deferrals is 4.125%, meaning the deferred tax amount will increase by this percentage each year.

Additional eligibility criteria include owner occupancy of the property, payment of all property taxes before 2024, and non-commercial use of the property.

To apply for the program, homeowners can visit colorado.propertytaxdeferral.com or contact 833-634-2513 (toll-free) or cotreasproptax@state.co.us for assistance.

For those seeking information on property tax exemptions for disabled veterans, gold star spouses, or senior citizens, inquiries can be directed to dola_dpt_frontdesk@state.co.us or by calling 303-864-7777 or 303-864-7758.

Categories

Recent Posts